Some changes have been made to the way a participant claims a refund through their NDIS plan. The NDIS now requires a receipt or tax invoice with an ABN included for all payments to be processed. Take a look at what receipts are acceptable in order to have your refund processed…

Participants can make purchases and claim the money back through their NDIS plan, as long as:

- The item must be considered reasonable & necessary by the NDIS (Visit the NDIS guidelines for more detail)

- There are available funds within the correct category of your NDIS plan

- An approved receipt or tax invoice is sent along with the request for refund

It is preferred that an Australian Business Number (ABN) be included on all receipt’s or tax invoice’s from the business you made the purchase.

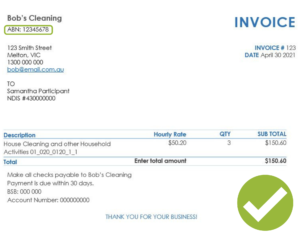

Here are examples of acceptable receipts we need a copy of, in order to process your refund:

RECEIPT TAX INVOICE

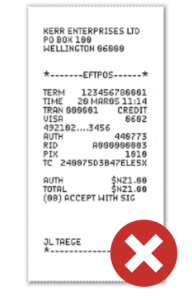

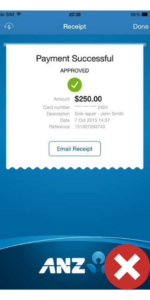

Here are some examples of forms of receipts we CANNOT except:

EFTPOS RECEIPT BANK TRANSFER SCREENSHOT SCREENSHOTS OF ORDER CONFIRMATIONS

Items you will NOT be able to claim a refund for:

X Second-hand items, purchased from another person who is NOT a business

X Bank transfer into another account without a Tax Invoice

If you are unsure if the item you would like to purchase will be covered within your NDIS plan, please contact our team before making the purchase on 1300 402 568.

To submit your refund Budgetnet:

Email – [email protected]

SMS – 0428 583 575

Mail- PO Box 28, Melton, VIC 3337

Include:

- A copy of an approved receipt/tax invoice

- The participants full name and NDIS number

We will process the refund into the bank account on file.

If you need to update your bank account details, please include: updated BSB, Account Number and Account Name.

For more information on refunds feel free to reach out to our team on 1300 402 568 or email [email protected].